dependent care fsa coverage

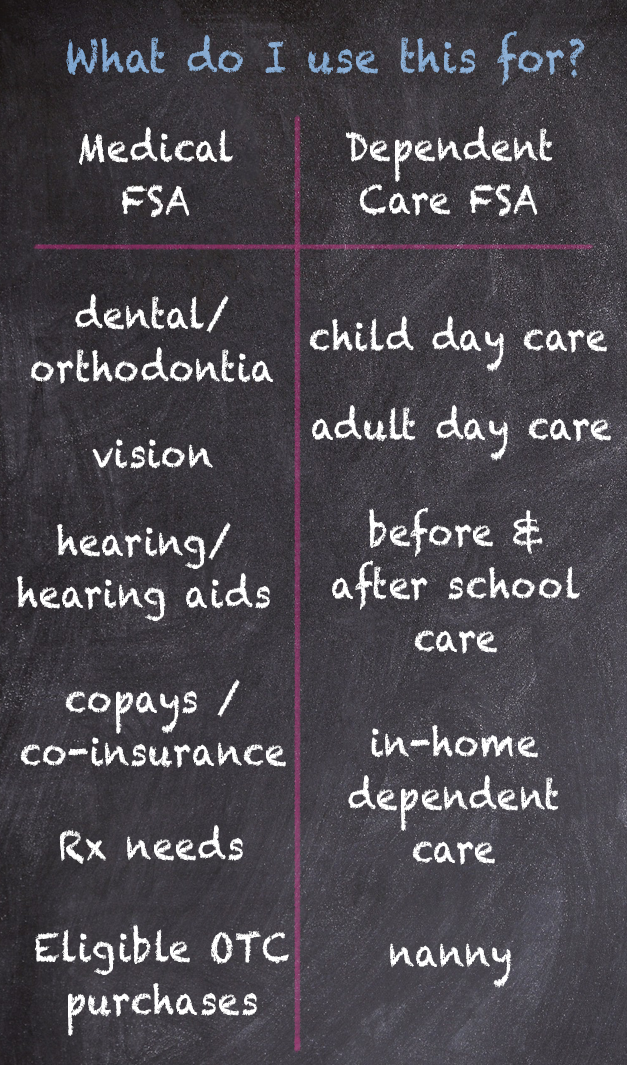

A Dependent Care FSA DCFSA is a pre-tax benefit account used to pay for eligible dependent care services such as preschool summer day camp before or. You can use your FSA funds to pay for a variety of expenses for you your spouse and your dependents.

Flexible Spending Accounts Pomona Ca

You can use your Dependent Care FSA DCFSA to pay for.

. Cost in dependent care coverage. A Dependent Care FSA account is generally used to cover expenses for the care of a qualified dependent under the age of 13 while the you and your spouse are. Claims payments made with Debit Card require nominimal claims substantiation by.

Judgment Decree or Order including QMCSOs Approved Leave. A dependent care flexible spending account FSA can help you put aside dollars income tax-free for the care of children under 13 or for dependent adults who cant care for themselves. If you and your spouse are divorced only the parent who has custody of the child reThe Federal Flexible Spending Account Program FSAFEDS offers an app to helThe money in your FSA can only be used for expenses for.

A dependent who is younger than 13 See more. Dependent Care FSA Cost or Coverage Changes. Dependent Care FSA Contribution Limits for 2022.

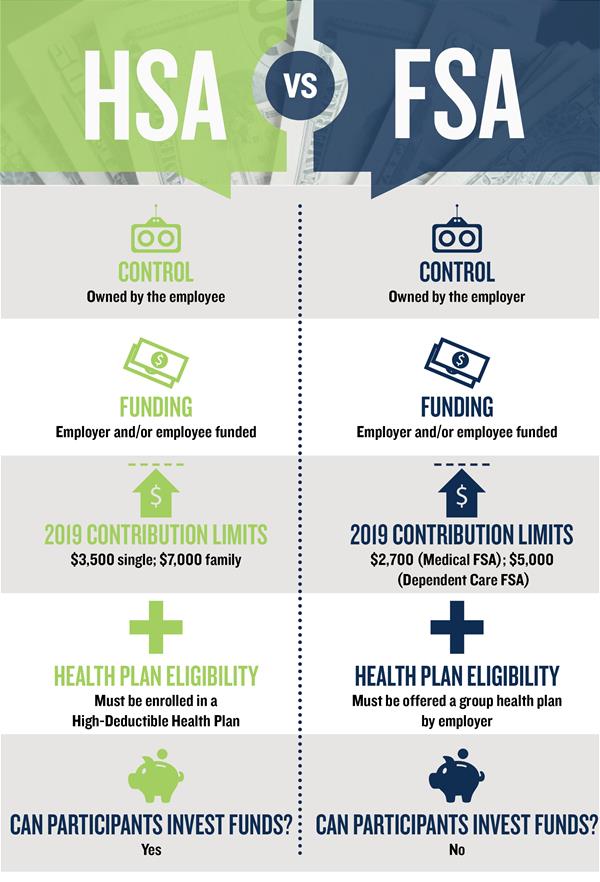

Learn about FSAs flexible spending accounts how FSAs work what they are and how they may help you cover out-of-pocket medical expenses. The Savings Power of This FSA. A dependent care flexible spending account covers qualified day care expenses for children younger than age 13 and adult dependents who are incapable of.

16 rows Various Eligible Expenses. Facts about Flexible Spending Accounts FSA They are limited to 2850 per year per employer. Participation in the FSA plan is not dependent upon enrollment in a group health plan.

The employee will generally have eligible dependent care FSA expenses for the services provided prior to the day the child reaches age 13. There is a significant change in the cost or coverage of dependent care such as a change in the dependent care provider subject to limits on care by relatives in the Internal Revenue Code. If youre married your spouse can put up to 2850 in an FSA with their employer too.

The law increased 2021 dependent-care FSA limits to 10500 from 5000 offering a higher tax break on top of existing rules allowing more time to spend the money. You or your spouse must be working searching for work or attending school. Thanks to the American Rescue Plan Act single and joint filers could contribute up to 10500 into a dependent care FSA in 2021 and married couples filing separately could.

A Dependent Care FSA DCFSA lets you use tax-free money to cover child care or adult dependent care. The IRS determines which expenses can be reimbursed by an. For 2022 the IRS.

What expenses are covered. Entitlement to Governmental Benefits. The IRS sets dependent care FSA contribution limits for each year.

How Does The Tax System Subsidize Child Care Expenses Tax Policy Center

Dependent Care Flexible Spending Account

What Is A Dependent Care Fsa Optum Financial

Flexible Spending Account Fsa Plan And Enrollment Information Ppt Video Online Download

Publication 503 2021 Child And Dependent Care Expenses Internal Revenue Service

Hsa And Fsa University Of Colorado

Covid 19 And Fsa News Updates Faqs Flexible Spending Accounts Fsa The City Of Portland Oregon

Does Fsa Cover Incontinence Products Tranquility Products

Dependent Care Fsa Vs The Child Care Tax Credit

Compare Medical Fsa And Dependent Care Fsa Bri Benefit Resource

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Everything You Need To Know About Dependent Care Fsas Youtube

Flexible Spending Accounts Ensign Benefits

How To Use A Dependent Care Fsa When Paying A Nanny

Sterling Administration Year End Hsa And Fsa Tips And Reminders Claremont Insurance Services

Dependent Care Flexible Spending Account Save On Care Expenses

Issues For Dependent Care Flexible Spending Accounts In 2020 And 2021 Web Benefits Design Corporation